The OCTA policy is your ally

The OCTA policy is a legally mandated compulsory civil liability insurance that covers losses caused by the driver of a traffic accident to third parties.

The OCTA policy operates throughout the European Economic Area, providing a compensation mechanism for traffic accidents regardless of the registration country of the at-fault vehicle.

OCTA is compulsory insurance for all drivers and owners of motorized land vehicles. It covers the owner's or user's liability in the event of a traffic accident but does not apply to losses incurred by the at-fault party.

The main purpose of OCTA is to protect the interests of third parties and help resolve conflicts between the parties involved in the accident. The cost of the OCTA policy depends on several factors, such as the insurer's terms, and the vehicle's parameters. To find the best offer, you can use the OCTA calculator, which allows you to compare prices and purchase a policy online. It is important to ensure that the policy is valid before hitting the road.

Before you start driving a vehicle, please ensure that you have a valid OCTA policy! You can check it here: https://services.ltab.lv/lv/CheckOcta

If you cause a traffic accident without a valid OCTA policy, you will have to cover all the damages to the injured party yourself, including the costs associated with claim processing. These can range from a few hundred to several hundred thousand euros, or more.

It may happen that you do not have the resources to cover the damages caused, in which case the OCTA Guarantee Fund will compensate the injured party, but will then claim this amount from you.

If the accident you caused results in harm to another person’s health, OCTA will cover their medical expenses, as well as temporary disability costs.

The OCTA system is designed to ensure that a road traffic accident victim (third party) can receive compensation for the damages incurred.

Here is a simple explanation of what the OCTA system is and how it works:

- Insurance Event: If you cause an accident with your vehicle and damage another vehicle or person, the injured party can claim compensation from the insurer from whom you purchased your OCTA policy.

- Extent of Damage: The insurer will assess the damages caused by the accident. This may include both material costs (e.g., repair of the damaged car) and medical expenses.

- Insurance Compensation: Your OCTA policy will cover expenses related to the health, vehicle, or property of the injured party.

Recourse Claim: If it turns out that the accident was caused maliciously or intentionally (for example, under the influence of alcohol or driving someone else's vehicle without permission) or if false information was provided, the insurance company may require you to reimburse the compensation paid to the injured party.

Our OCTA calculator offers cheap OCTA prices from all Latvian insurers. We offer insurance policies for both passenger and commercial vehicles, taxis, special-purpose vehicles, trailers, motorcycles, scooters, and special machinery. Any unit subject to mandatory civil liability insurance for vehicle owners.

The prerequisite for buying cheap OCTA is comparing OCTA prices in the OCTA calculator. Of course, the better your loss history, the cheaper your OCTA policy will be.

The OCTA policy essentially does not differ, as the OCTA law determines the risks and the amount of compensation that insurers must cover. Therefore, the main selection criterion is usually the cheapest OCTA policy price, unless you want to buy an OCTA policy with various additional risks – direct loss settlement (TZR), car evacuation, accident insurance, roadside assistance, mini KASKO, etc.

Insurers compete not only with the cheapest prices and additional insurance risks but also with service quality, especially if an OCTA with the additional risk “Direct Loss Settlement” (TZR) and other additional risks is selected. Direct loss settlement means that the claim for compensation can be made not to the insurer of the guilty vehicle’s owner but to the insurer from whom the OCTA policy was purchased. If you have questions about the OCTA policy price, coverage, or the OCTA compensation process related to a road traffic accident, we will be happy to assist you via WhatsApp – 27541000, or email info@octaok.lv. Compare and check OCTA prices with our calculator and make a quick and easy purchase!

If an accident occurs in which no one is injured and both drivers can agree on the circumstances, filling out a mutual report is sufficient. This form should also include information about your OCTA insurer. Learn more here:

https://youtu.be/jU3PgPh1-nw?si=Ly1KtD29-1XcnEfC

https://youtu.be/dMDTDVlCyM8?si=jeIpYDIONPPGzHj9

OCTA will cover losses for the injured party up to 5,000,000 euros, regardless of the number of injured persons. Property damages will also be covered up to 1,000,000 euros, regardless of the number of third parties.

If you know the responsible insurer (the at-fault party), you can submit a claim remotely here:

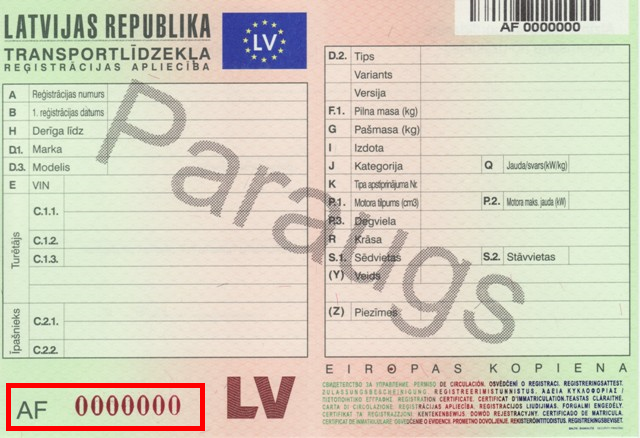

An OCTA calculator is an online tool that allows you to quickly and conveniently compare mandatory motor third-party liability insurance (OCTA) prices from various insurers. By entering the car's license plate number and other required information (registration number and certificate details), the calculator instantly provides current offers from multiple insurers, enabling the customer to choose the most advantageous option. It saves time and helps make an informed decision based on price, coverage period, and additional offers.

The service is provided by SIA Montea Insurance Brokers.